Frequently Asked Questions

-

What is a Tax sale?

A transfer of real property (or a lien against property), in exchange for money to satisfy charges imposed thereupon by the government that have remained unpaid after the legal period for their payment has expired. Whether the county sells the deed to the property, or a lien against the property varies by state, and sometimes, even by county. Some states (like Florida) have both lien, and deed sales. Both can have bidding in excess of the minimum due, which is commonly called excess proceeds, or excess funds.

-

Who carries out a Tax Sale?

Each county has a different procedure. Some Tax offices do it themselves, while other counties ask the Sheriff (sheriff sale), or an outside attorney to hold the sale.

-

What is the difference between a Tax Lien sale and a Tax Deed sale?

When county governments sell tax liens, they are selling the debt owed to the government and not the actual property itself. When a Tax Deed is sold, the county is selling the property outright. Tax liens and deeds are sold at an auction which is usually held monthly or annually on the courthouse steps. Each state will utilize either tax lien sales or tax deed sales as the method of collecting delinquent taxes. A tax lien or tax deed sold may be redeemable by the taxpayer for a designated period of time after the sale, depending on the county. A tax lien sold may be converted into a deed after a certain period of time (if the lien is not satisfied).

-

What is a list?

A list is a document from the county summarizing the results of their tax sale/auction. It is itemized by property indicating the property description, minimum bid, sale price, excess proceeds/funds, and time of sale.

-

What are Excess Proceeds?

Excess proceeds are created when the final bid on a property exceeds the minimum bid, which is usually the tax liability, interest, court costs, penalties, or fees. They are also known as excess funds, tax overbids, tax overages, surplus funds, or tax lien surplus.

Here’s an example:

- Joe owns a property

- Joe owes $10,000 in property taxes on this property

- Joe fails to pay the taxes

- The county auctions the property to the highest bidder resulting in a final sale price of $100,000

- The county takes the $10,000 it is owed in delinquent taxes

- The remaining $90,000 goes into a county trust account

- This $90,000 belongs to Joe, the original owner

-

Why wouldn’t Joe just collect the money?

Because there’s a pretty good chance that Joe never knew he had a right to the money. Most counties are required to send notification to the address of record, but the wording may be vague, and often, Joe (original owner/ taxpayer) has moved, or been evicted, and never receives, or understands it.

-

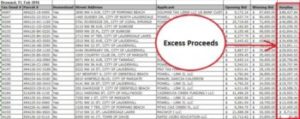

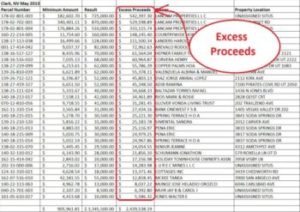

What does a list look like?

All lists are different, there is no standardization. Some lists are back office working documents, while others are formatted nicely for public viewing. Before we include any list in our database, we ensure that it has the following minimum requirements to be considered a “verified” list….

- Property description (parcel number, case number, name, or address)

- Minimum bid

- Sale price

- At least one property with excess proceeds of at least $5,000.00

List Examples…

-

How do you get the lists?

We get our data by submitting FOIA requests one at a time.

-

How often can I get lists?

We receive lists on a daily basis and make them available to our subscribers weekly, on Fridays. We then post the individual county lists to our existing database, where they can be searched, sorted, and filtered by subscribers. (link this to the subscription page)

-

Can I keep my lists?

Yes, you download the lists to your own computer for your own use.

-

What is the real value of these excess proceeds lists?

The National Association of County collectors, Treasurers, and Finance officers estimates the total amount of excess proceeds to be in the billions. You are usually allowed to collect a fee for reuniting these funds with their rightful owner. Each state has published limits, and some are very generous. Additionally, most lists indicate which properties did not sell, which is also beneficial.

-

What do you get with a subscription?

Subscribers get a constant weekly flow of current and updated tax sale result lists, and excess proceeds lists. You receive a minimum of 50 lists per month (usually more), and receive them weekly on Fridays. Additionally, subscribers have access to 5 additional files each month from our historical database. If more historical lists are needed, they are available at a small fee.

-

I’m new at this, am I ready for a subscription?

Yes, seeing lists from different counties and states is an education by itself. Each county has it’s own particular rules and regulations. By reading tax sale result files from many disparate counties, one begins to get a better perspective of the industry, and should be mandatory reading (in our opinion).

-

Do you have enhanced lists, and what are they?

Yes, these are the gold standard, pre-assembled lists. Occasionally, we provide special enhanced lists to our subscribers. Enhanced lists have higher minimum overages for each item, usually $20,000.00, and have verified owner/taxpayer/recipient names, property addresses, mailing addresses (if different), case numbers (if any), parcel numbers, etc…and the overages are verified outstanding as of the day we release the list. If you are experienced, you understand the value of these lists.

-

Do you have the county forms to start a claim?

No. Each county has its own forms. It’s best to call the county for the most current version of the forms, we don’t keep them.